By Pam Martens and Russ Martens: July 24, 2023 ~

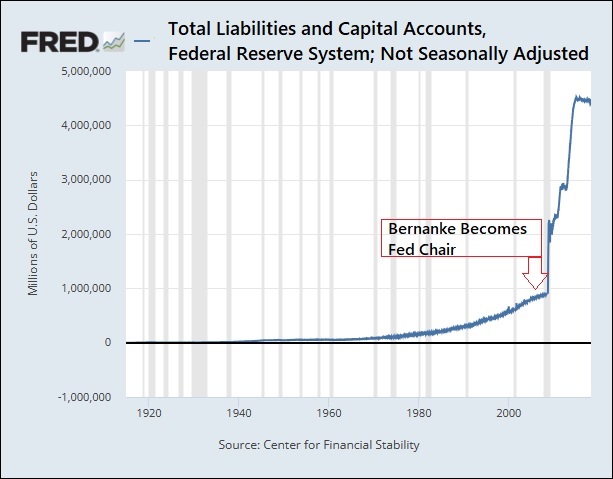

Prior to Ben Bernanke being sworn in as Fed Chair on February 6, 2006, the United States had been through World War I, the Great Depression, World War II, the Vietnam War and the stagflation of the 1970s, without an explosion in the Fed’s balance sheet. But since Ben Bernanke, Janet Yellen and Jerome Powell have, in turn, sat at the helm of the Federal Reserve, there has been unprecedented growth in the Fed’s Balance Sheet.

For example, from June 1960 to August 1990, the Fed’s balance sheet increased from $53 billion to $309 billion – an increase of 483 percent in 30 years. But during the tenures of Bernanke, Yellen and Powell, the Fed’s balance sheet has exploded from $805 billion in February 2006, when Bernanke took his seat as Fed Chair, to the current reading last Wednesday, July 19, 2023, of $8.3 trillion. That’s an increase of 931 percent in just a little over 17 years. The trajectory on the chart above says it all.

This unprecedented growth in the Fed’s balance sheet has come as a result of a Fed strategy known as “Quantitative Easing,” or “QE,” a wonky-sounding term that the Fed hoped would be incomprehensible to most Americans. What QE essentially boiled down to was the Fed artificially driving down interest rates by creating artificial demand for debt securities, which it bought by trillions of dollars and parked on its balance sheet. Beginning with Bernanke and his rollout of QE, the Fed morphed from lender of last resort to federally-insured banks (its mandate under the Federal Reserve Act) to buyer of last resort for what Wall Street regurgitated (not its mandate anywhere to be found in the Federal Reserve Act).

Now the Fed is stuck with this monster balance sheet when it needs to be raising rates to fight inflation, not holding rates down.

There are many reasons that the Fed openly operates outside of its statutory mandate. Among them are the following:

The Federal Reserve Board of Governors has outsourced its open market operations to the New York Fed, which is, literally, owned by a handful of Wall Street megabanks. (See related articles below.)

Congress has failed to separate the giant federally-insured banks from the Wall Street casino (trading houses), by restoring the Glass-Steagall Act, which has resulted in perpetual bailouts by the Fed.

The advent of the 401(k) plan which incentivizes U.S. workers to save for retirement through investments in the stock market (or, to a smaller extent, the bond market). This removes much of the public outcry to Congress when the Fed bails out Wall Street, because tens of millions of workers feel that their retirement savings are also being bailed out. To fully grasp this concept, see our 2008 report on the “ownership society.” (Unknown to the average American, the top 10 percent of the wealthiest households in America own the vast majority of the stock market. So that’s who is actually getting bailed out, along with the residents of the corner offices on Wall Street. For how the average American is faring, see: PBS Drops Another Bombshell: Wall Street Is Gobbling Up Two-Thirds of Your 401(k).

For an interactive look at our chart above, put your cursor at various points on the chart (at this link) for a weekly reading of the Fed’s balance sheet back to 1914.

Related Articles:

Fed Chair Bernanke Held 84 Secret Meetings in the Lead Up to the Wall Street Collapse

New York Fed’s Answer to Cartels Rigging Markets – Form Another Cartel

Is the New York Fed Too Deeply Conflicted to Regulate Wall Street?